Note: The creation of this article on testing Error Prevention (Legal, Financial, Data) was human-based, with the assistance on artificial intelligence.

Explanation of the success criteria

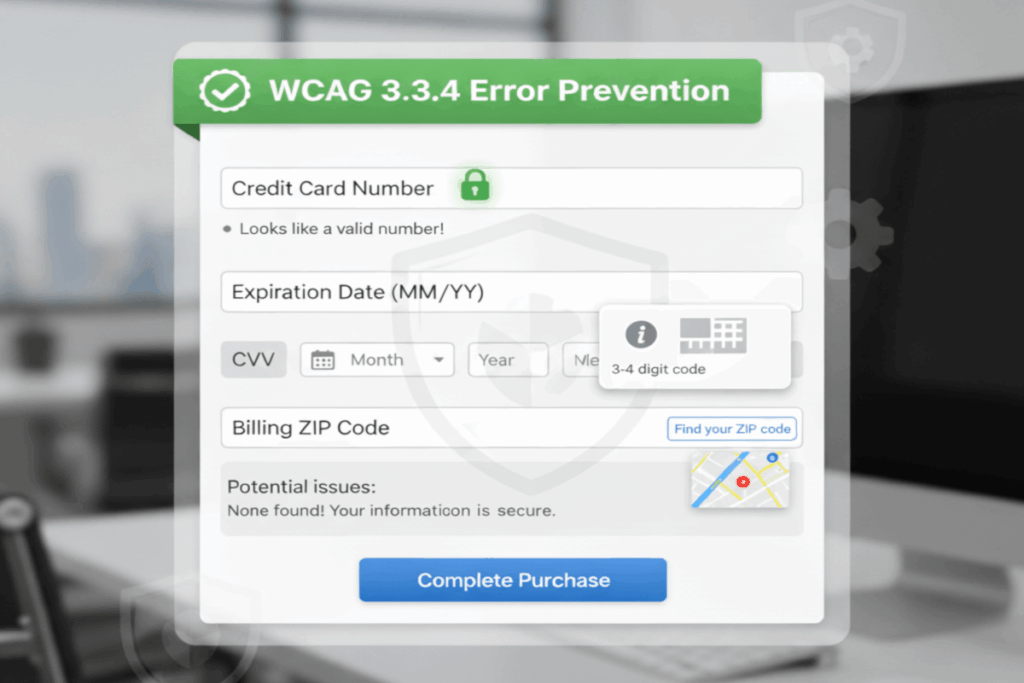

WCAG 3.3.4 Error Prevention (Legal, Financial, Data) is a Level AA conformance level Success Criterion. It is focused on safeguarding users from costly or irreversible mistakes during critical interactions. It requires that web pages involving legal commitments, financial transactions, or significant data submissions provide users with an opportunity to review, confirm, or reverse their input before finalizing an action. This ensures that individuals, including those with cognitive, motor, or visual disabilities, can participate confidently in high-stakes digital processes. Thoughtful design practices such as confirmation screens, edit options, and clear summaries not only meet accessibility requirements but also build user trust and reduce organizational risk. By embedding error prevention as a core usability principle, organizations demonstrate maturity in digital accessibility and a proactive commitment to equitable user experiences.

Who does this benefit?

- People with cognitive or learning disabilities who may struggle to detect or correct complex input errors before submission.

- Users with visual impairments who rely on assistive technologies and may miss critical on-screen cues about irreversible actions.

- Individuals with motor disabilities who may accidentally trigger a submission or transaction due to limited control or unintentional clicks.

- Users under stress or distraction who benefit from confirmation steps that reduce the cognitive load and risk of costly mistakes.

- Organizations handling sensitive data that gain trust, credibility, and reduced liability by ensuring users can verify information before committing actions.

Testing via Automated testing

Automated testing excels at quickly identifying missing standard features such as absent confirmation dialogs, missing form validation attributes, or incomplete error-handling mechanisms across large-scale systems. It is fast, consistent, and scalable, but it falls short in evaluating the quality, clarity, and user comprehension of error-prevention flows, particularly in complex legal or financial contexts.

Testing via Artificial Intelligence (AI)

AI-based testing introduces a more intelligent layer, simulating user interactions and analyzing whether users might encounter irreversible errors or confusing workflows. AI can flag patterns that suggest potential risk and highlight ambiguous messaging, yet it still struggles to fully interpret context, legal nuances, or emotional impact of errors on end users.

Testing via Manual testing

Manual testing, often performed by accessibility specialists and real users, including those with disabilities, is indispensable for evaluating the effectiveness of error-prevention mechanisms in real-world scenarios. Manual assessment captures subtleties like the clarity of confirmation prompts, readability of error messages, and the cognitive load imposed on users during high-stakes actions. However, it is resource-intensive, time-consuming, and subject to human bias.

Which approach is best?

A thoughtful, hybrid approach leverages automated and AI testing for breadth and efficiency while relying on manual testing to validate real-world usability and user comprehension, ensuring error prevention mechanisms are not only present but genuinely protective and user-centered.

A robust hybrid approach begins with automated testing to establish a baseline of compliance. Automated tools efficiently scan for the presence of critical elements such as confirmation dialogs, reversible action mechanisms, and form validation attributes across all relevant workflows. This step quickly identifies obvious gaps and ensures consistent implementation of foundational error-prevention features.

Next, AI-based testing enhances the process by simulating user behavior through realistic interaction scenarios. AI can detect potential friction points, highlight ambiguous instructions, or flag sequences where users may unknowingly commit irreversible actions. It also helps surface patterns that might indicate cognitive overload or confusing navigation, particularly in high-stakes financial, legal, or data-entry tasks.

The final, essential layer is manual testing, which validates the user experience in real-world contexts. This involves accessibility specialists and users with disabilities performing transactions, submissions, or data edits to evaluate whether confirmation screens, undo options, and error messages are meaningful, intuitive, and effectively prevent costly mistakes. Manual testing also assesses the emotional and cognitive impact of error-prevention flows, something automated and AI methods cannot fully gauge.

By combining these three approaches, automated for scale, AI for intelligent pattern detection, and manual for nuanced human insight, organizations achieve a comprehensive, user-centered evaluation that not only ensures compliance but actively protects users from errors that could have serious legal, financial, or data-related consequences.

Related Resources

- Understanding Success Criterion 3.3.4 Error Prevention (Legal, Financial, Data)

- mind the WCAG automation gap

- Providing the ability for the user to review and correct answers before submitting

- Providing a checkbox in addition to a submit button

- Providing a stated time within which an online request (or transaction) may be amended or canceled by the user after making the request

- Providing the ability to recover deleted information

- Requesting confirmation to continue with selected action

- Providing client-side validation and alert

- Providing success feedback when data is submitted successfully